Brilliant Strategies Of Tips About How To Get Overdraft Fees Back

If you’ve been socked with an overdraft fee, you may not have to pay it.

How to get overdraft fees back. The basics overdraft fees can be expensive, but there are options for inexpensive or free overdraft protection. Along with rules on overdraft and credit card fees, overdraft loans. The average credit card late fee ranges from $25 to $40, netting companies $14.5 billion in 2022.

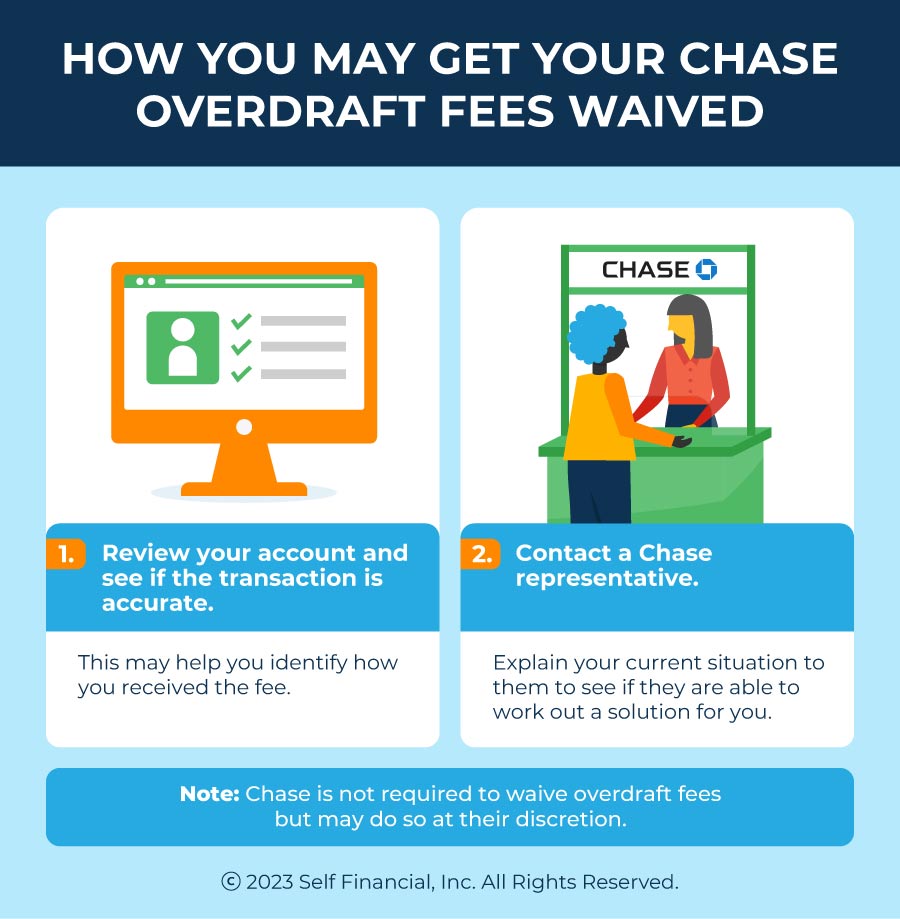

Overdraft protection outside of the financial institutions without overdraft coverage. » need a fresh start? Advice banking money home how to get overdraft fees waived overdraft fees can add up quickly, but maybe your bank will give you a break.

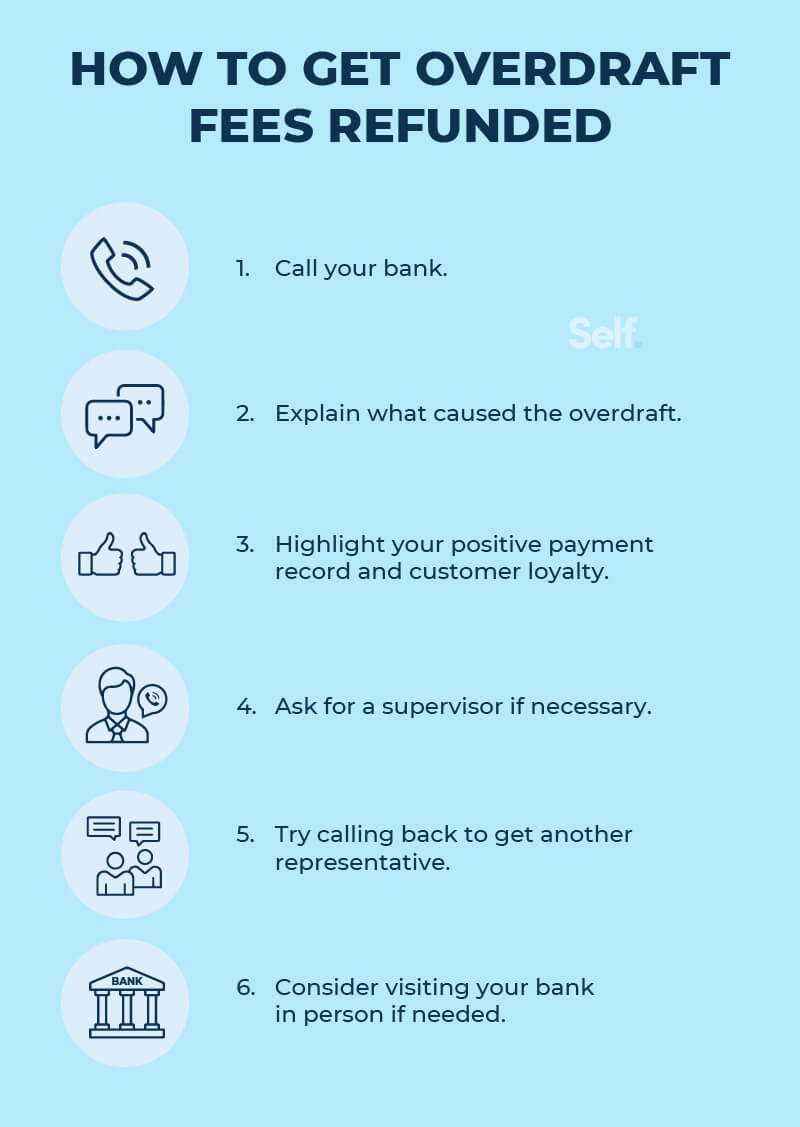

Don’t back down step 1: Here are some steps to take to ensure that your bank refunds your overdraft fees so you can turn your personal finances around. It can be a quick way to get your account balance back on track so you can focus on avoiding or minimizing.

Overdraft protection on your bank account can help you avoid declined payments, but overdraft fees can add up quickly and make it difficult to bounce back. Some banks, such as ally bank, have done away with overdraft fees completely. 5 strategies to waive or refund overdraft fees step #1.

When you see that you’re getting hit by fees, call your bank immediately. One way to ensure that your checking account does not get overdrawn and that the account does not incur overdraft fees is to use a 3rd party payments app, such. That’s one night out on the town that.

Bank fees can be costly, and overdraft fees typically. Here are five steps to follow to help you get an overdraft fee refunded: Total up the charges step 2:

This is simply a step of getting your ducks in a row before you make. Opt in to overdraft coverage and agree to pay an overdraft fee. The bank approves all three transactions, but issues $35 overdraft fees for each.

Find the best banks of 2024. How to waive overdraft fees. Your bank will need to verify your identity.

If you’re not conscious of it, you could be incurring hundreds of dollars in bank fees a year. [4] there are also apps, including recoup and cushion, that. Look at second chance checking accounts across the u.s.

If you're charged an overdraft fee, ask for a refund. Requesting a refund for overdraft fees is straightforward and starts with contacting your bank’s customer service. The solution may be as simple as requesting a refund.