Spectacular Info About How To Improve Your Credit Rating Uk

![Improve Your Credit Rating [INFOGRAPHIC] Infographic List](https://i.pinimg.com/originals/22/77/10/2277104ae9b2cf10f6adee8f2db2e285.jpg)

Registering on the government’s electoral roll (sometimes called the electoral register) can improve your credit score because it provides proof of your home.

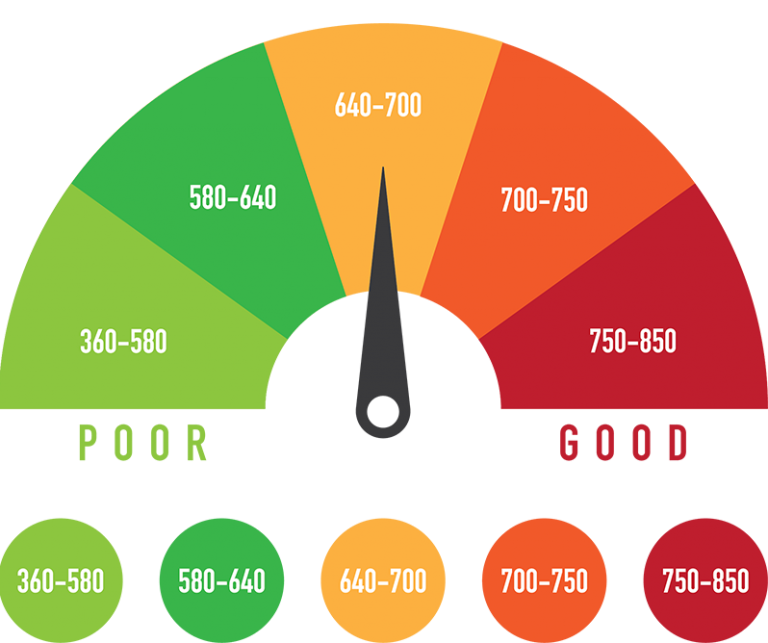

How to improve your credit rating uk. If your credit score is low, then are some quick steps you can take to give your ratings a boost: How they decide your credit score the first step to improving your credit score is understanding how it’s set. If you've been wondering about how to increase your credit score or want to understand it better — loqbox can help!

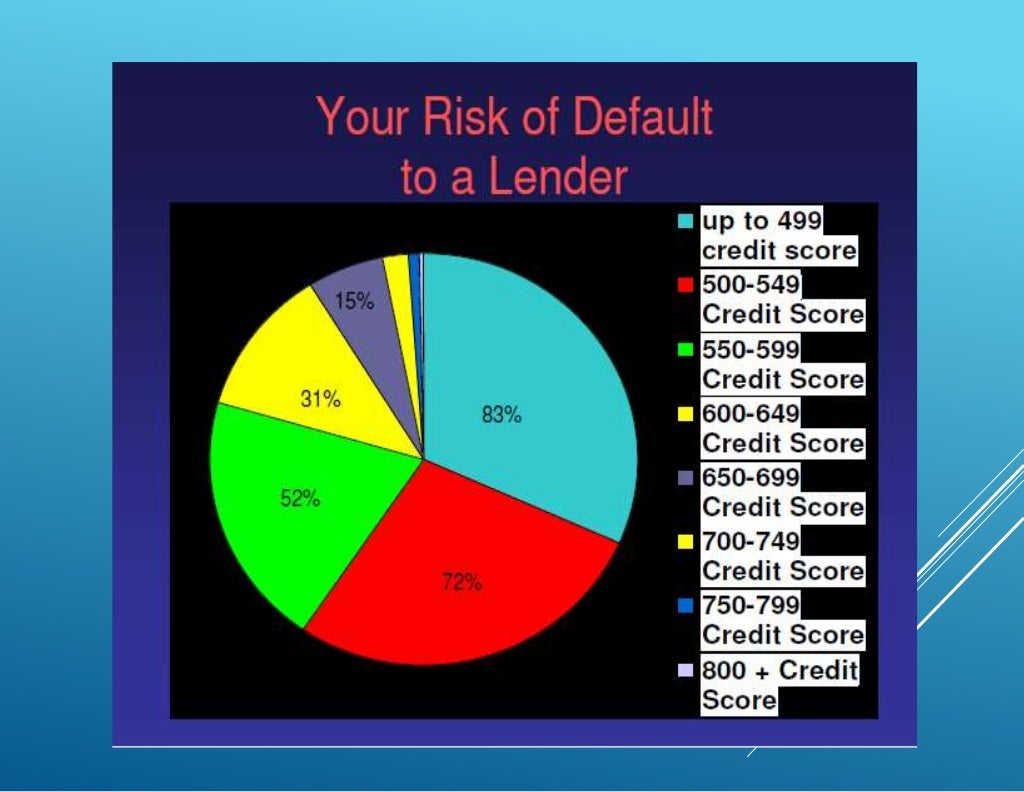

No credit rating or score is set in stone, and while you can’t wipe your credit rating clean straight away, there are ways to improve. Having a good credit score can help increase your chances of getting accepted for credit in the future, as well as providing access to better interest. Check your credit file to ensure all the information held on.

How to improve your credit rating or score. Compare how to improve your credit score improve your credit standing and your chances of getting approved for credit by following these 16 simple steps. Clearscore (uses equifax data) credit karma (uses transunion data) each platform also offers a full credit report, monitoring services and eligibility calculators to.

Here are 12 speedy steps you can take to boost your score. Having a good history of paying off the balance on your credit card on time and in full is one of the best ways to improve your rating. Yet there's one number you shouldn't pay too much attention to.

Now that you know what your credit score is and the impact it can have on borrowing money, here are some tips on how to improve yours as fast as possible: Use a bank account setting up direct debits to make regular payments could boost your credit score over time. Here are the ranges experian defines as poor, fair, good, very good and exceptional.

Pay on time. With the right steps, like meeting your repayments, registering on the electoral roll and checking your credit report for errors, you should see improvements. And it only takes a few steps.

How to boost your credit score. Feeling unsure about finances is pretty common. When you apply for a loan in the uk, lenders check to see if you are a financial risk by evaluating your creditworthiness, which is why it is vital to know how to.

How to improve your credit score a good credit score can mean you qualify for cheaper rates on things like loans, credit cards, mobiles and mortgages. In the uk, the credit reference agencies experian, equifax and transunion build credit reports using information from uk accounts only, so if you've just moved here, you'll probably find that your report looks quite bare, which'll impact your ability to get. Check for errors on your credit report.

Just make sure there’s money in your account to cover any. Get your equifax credit report and score.

![Improve Your Credit Rating [INFOGRAPHIC] Infographic List](https://i1.wp.com/infographiclist.files.wordpress.com/2012/03/improveyourcredit_4f5a63571c6c6.jpg)

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)