Best Info About How To Improve Your Credit Score In 6 Months

Even though you pay it off in full every month, the card still has an.

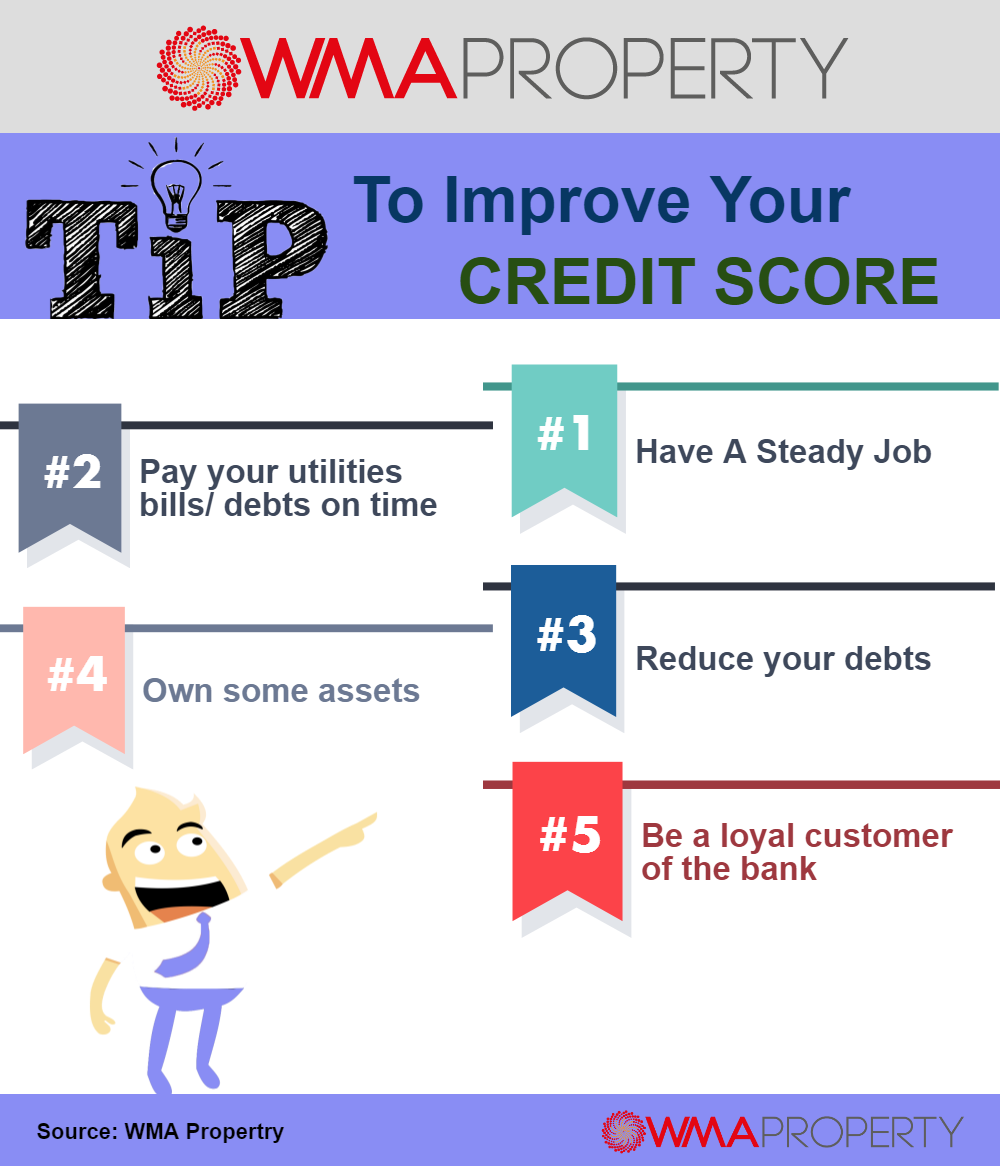

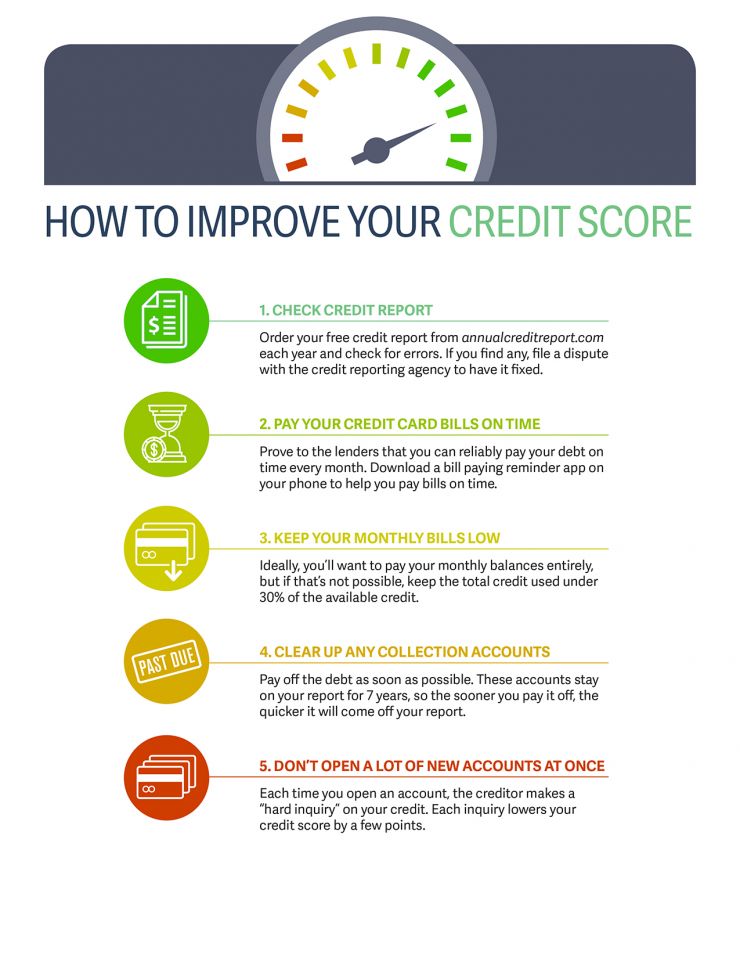

How to improve your credit score in 6 months. A good or excellent credit score will save most people hundreds of thousands of dollars over the. Paying your bills on time is the most important thing you can do to help raise your score. If you don’t have a good credit score, you’ll likely be denied credit or have higher interest rates, but you can raise your score in as little as 3 to 6 months.

Keep in mind that each time. If approved, the new rules around the $2,000 child tax credit would be more modest and cover three tax years: Credit reporting errors, such as the wrong payment status and.

Here's an example of how this would work. It could take anywhere from one month to 10 years to improve your credit score, depending on your situation and what negative marks you need to improve on. Apply for an easy credit card my first credit card was a student card.

Make your payments on time. The major contributing factor to improving my credit score in just 30 days was decreasing my credit utilization ratio. Develop a budget and stick to it.

I lowered my credit utilization ratio by 19%! The representative should review the. Start by creating a realistic budget that.

Here is a list of easy tips to fix credit in 6 months: Fico and vantagescore, which are. Make sure your credit reports are accurate the three leading credit reporting agencies—experian, transunion and equifax—collect your credit information.

That means if it's approved you. Being on the electoral roll gives lenders proof that you are who you. These are designed specifically for students with limited credit history.

Paying down your credit card balances will free up more of your available credit, reducing your debt to credit ratio and improving your credit score. Taking control of your finances is another fundamental step toward fixing your credit. The time it takes to raise your credit score depends upon the reason (s) that your score is lower in the first place.

Let's say you have a single credit card with a limit of $5,000. Register on the electoral roll. The longer your accounts are open and in good.

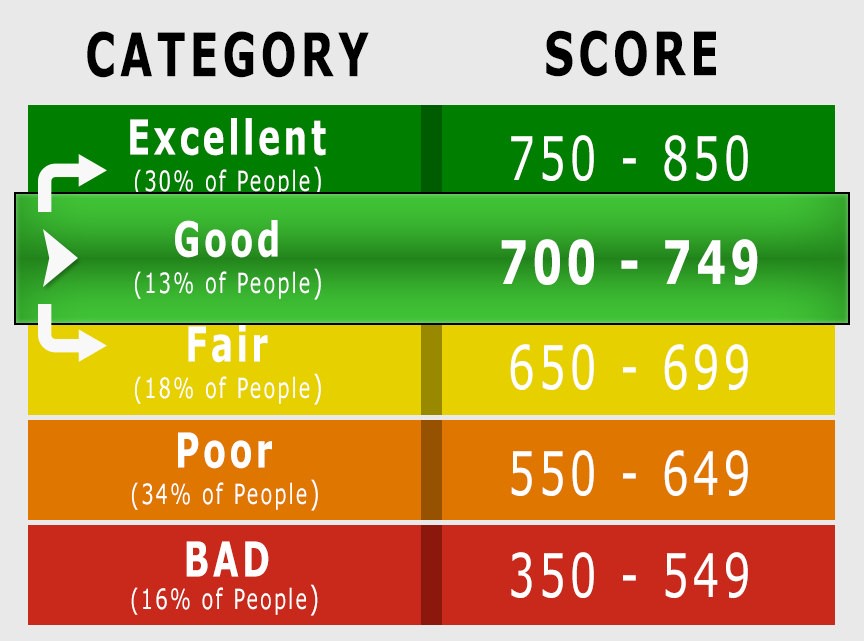

Here are the ranges experian defines as poor, fair, good, very good and exceptional. When calling your issuer, tell the customer service representative you’d like to request a credit limit increase on your card. Learn about the basics of credit pay down credit card balances promptly maintain credit portfolio balance try.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)